Al Mal Capital Reit

al mal capital reit - Welcome to our internet site. you may look for articles that in shape your interests because we've got information this is constantly updated and written in a comfortable language style that is easy for everybody to apprehend. this time the admin will talk articles about al mal capital reit.

Dubai Financial Market DFM Monday hosted a bell ringing ceremony to celebrate the commencement of Real Estate Investment Trusts REITs trading with the listing of Al Mal Capitals REIT trading symbol. Al Mal Capital REIT received SCAs license to operate as a real estate investment fund on 21st December 2020.

Dubai Financial Market DFM achieved a key milestone in its journey by introducing Reit trading at the exchange to diversify product offering and asset classes broadening the scope of.

Al mal capital reit. Al Mal Capital REIT engages in real estate investment services. In addition we provide you with news for the listed company in the financial market. The listing culminates the successful floating of the new fund by Al Mal Capital a subsidiary of Dubai Investments in November 2020.

The company has received regulatory approval to list Al Mal Capital REIT on Dubai Financial Market PJSC according to a statement on Monday.

Al-Mal Capital announced today that it has obtained the approval of the Securities and Commodities Authority for the initial public offering of the recently established Real Estate Investment Trust which is concerned with real estate investment which has a closed capital aimed at listing all its units in Dubai Financial Market as of January 2020. And development thanks to the attractive trading and listing environment in which the market has been successful.

The AED350 million proceeds of this fund will be invested by the company in a Sharia-compliant diversified portfolio of income generating properties that serve different sectors such as.

Al Mal Capital is a diversified multi-line investment institution headquartered in Dubai and licenced and regulated by the UAE Securities and Commodities Authority SCA. Al Mal Capital REIT is managed by Al Mal Capital which was founded in 2005It is a leading investment advisory and asset management firm regulated by SCA and UAE Central Bank and a subsidiary of Dubai Investments.

The new entity Al Mal Capital REIT will list on Dubai Financial Market in January.

We are pleased to welcome Al Mal Capital REIT as DFMs first REIT listing and look forward to welcoming additional REIT listings on the market as this asset class has a promising growth potential supported by DFMs world-class listing and trading regulations in line with international best practices and requirements of various market participants. The introduction of REITs is a key milestone in DFMs.

Al Mal Capital Reit closed its initial public offering on December 8 and received regulatory approval to operate as a property investment fund last week the company said in a statement to the Dubai Financial Market on Monday.

The company was founded in 2005 and is headquartered in Abu Dhabi United Arab Emirates. The introduction of REITs is a key milestone in DFMs journey to diversify product offering and asset classes.

Al Mal Capital REIT plans to acquire a diversified portfolio of real estate properties targeting long-term lease agreements.

Al Mal Capital REIT will be the first to list on the DFM in January 2021 subject to final approval from the SCA DFM. The IPO proceeds along with Islamic financing from local banks will be utilised to invest in a diversified portfolio of high-performing UAE sectors including healthcare education and industrial assets with a target annual return of 7 per cent.

thank you for journeying our website. i'm hoping the object that we mentioned above offer blessings for readers and many people who've visited this internet site. we hope for aid from all parties for the development of this internet site to be even higher.

The Corporate Advisory division at Al Mal Capital offers a wide range of corporate finance advisory mergers and acquisitions equity capital market and family office services to our local and regional clients that include family offices small to medium size enterprises investment companies conglomerates and private equity firms and publically listed entities. Stock analysis for Al Mal Capital REIT 1841619DDFM including stock price stock chart company news key statistics fundamentals and company profile. Healthcare education and industrial assets with a target annual return of 7.

Supported by robust trading and listing framework in line with international best practices - ZAWYA UAE Edition.

We welcome Al Mal Capital REIT as the first real estate investment fund on the market and we look forward to listing more real estate investment funds in the next stage as this asset category has promising growth opportunities. It intends to create a Dh500 million fund and proceeds will be utilized to invest in a diversified portfolio of.

You may also find various basic and advanced charts that could be helpful in making decisions about the trend of the stock rise or fall and in.

Al Mal Capital an asset management subsidiary of Dubai Investments raised Dh350 million 9537m through the public float of its real estate investment trust or Reit. Healthcare education and industrial assets with a target annual return of 7.

Stock analysis for Al Mal Capital REIT 1841619DDFM including stock price stock chart company news key statistics fundamentals and company profile.

The Corporate Advisory division at Al Mal Capital offers a wide range of corporate finance advisory mergers and acquisitions equity capital market and family office services to our local and regional clients that include family offices small to medium size enterprises investment companies conglomerates and private equity firms and publically listed entities. The listing culminates the successful floating of the new fund by Al Mal Capital a subsidiary of Dubai Investments in November 2020.

In addition we provide you with news for the listed company in the financial market.

Al Mal Capital REIT engages in real estate investment services.

thank you for touring our website. i'm hoping the object that we discussed above offer advantages for readers and plenty of humans who have visited this website. we are hoping for aid from all events for the improvement of this internet site to be even higher.

Al Mal Capital an asset management subsidiary of Dubai Investments raised Dh350 million 9537m through the public float of its real estate investment trust or Reit. You may also find various basic and advanced charts that could be helpful in making decisions about the trend of the stock rise or fall and in. It intends to create a Dh500 million fund and proceeds will be utilized to invest in a diversified portfolio of.

thank you for journeying our website. i'm hoping the object that we discussed above offer benefits for readers and many human beings who have visited this internet site. we are hoping for help from all parties for the improvement of this website to be even better.

We welcome Al Mal Capital REIT as the first real estate investment fund on the market and we look forward to listing more real estate investment funds in the next stage as this asset category has promising growth opportunities. Supported by robust trading and listing framework in line with international best practices - ZAWYA UAE Edition. The IPO proceeds along with Islamic financing from local banks will be utilised to invest in a diversified portfolio of high-performing UAE sectors including healthcare education and industrial assets with a target annual return of 7 per cent.

thanks for travelling our website. i'm hoping the article that we discussed above offer benefits for readers and plenty of people who've visited this website. we hope for help from all events for the development of this website to be even higher.

Al Mal Capital REIT will be the first to list on the DFM in January 2021 subject to final approval from the SCA DFM. Al Mal Capital REIT plans to acquire a diversified portfolio of real estate properties targeting long-term lease agreements. The introduction of REITs is a key milestone in DFMs journey to diversify product offering and asset classes.

thanks for travelling our internet site. i am hoping the object that we mentioned above provide blessings for readers and lots of human beings who've visited this internet site. we are hoping for aid from all events for the improvement of this internet site to be even higher.

The company was founded in 2005 and is headquartered in Abu Dhabi United Arab Emirates. Al Mal Capital Reit closed its initial public offering on December 8 and received regulatory approval to operate as a property investment fund last week the company said in a statement to the Dubai Financial Market on Monday. The introduction of REITs is a key milestone in DFMs.

thanks for touring our internet site. i am hoping the thing that we discussed above provide benefits for readers and many humans who have visited this website. we hope for aid from all events for the development of this website to be even better.

We are pleased to welcome Al Mal Capital REIT as DFMs first REIT listing and look forward to welcoming additional REIT listings on the market as this asset class has a promising growth potential supported by DFMs world-class listing and trading regulations in line with international best practices and requirements of various market participants. The new entity Al Mal Capital REIT will list on Dubai Financial Market in January. Al Mal Capital REIT is managed by Al Mal Capital which was founded in 2005It is a leading investment advisory and asset management firm regulated by SCA and UAE Central Bank and a subsidiary of Dubai Investments.

thank you for touring our internet site. i hope the object that we discussed above provide blessings for readers and lots of people who have visited this website. we are hoping for help from all parties for the development of this internet site to be even better.

Al Mal Capital is a diversified multi-line investment institution headquartered in Dubai and licenced and regulated by the UAE Securities and Commodities Authority SCA. The AED350 million proceeds of this fund will be invested by the company in a Sharia-compliant diversified portfolio of income generating properties that serve different sectors such as. And development thanks to the attractive trading and listing environment in which the market has been successful.

thank you for journeying our internet site. i hope the item that we mentioned above offer advantages for readers and plenty of human beings who've visited this website. we hope for aid from all events for the development of this website to be even higher.

Al-Mal Capital announced today that it has obtained the approval of the Securities and Commodities Authority for the initial public offering of the recently established Real Estate Investment Trust which is concerned with real estate investment which has a closed capital aimed at listing all its units in Dubai Financial Market as of January 2020. The company has received regulatory approval to list Al Mal Capital REIT on Dubai Financial Market PJSC according to a statement on Monday.

thank you for touring our website. i hope the object that we discussed above provide benefits for readers and plenty of people who have visited this website. we are hoping for guide from all events for the improvement of this internet site to be even better.

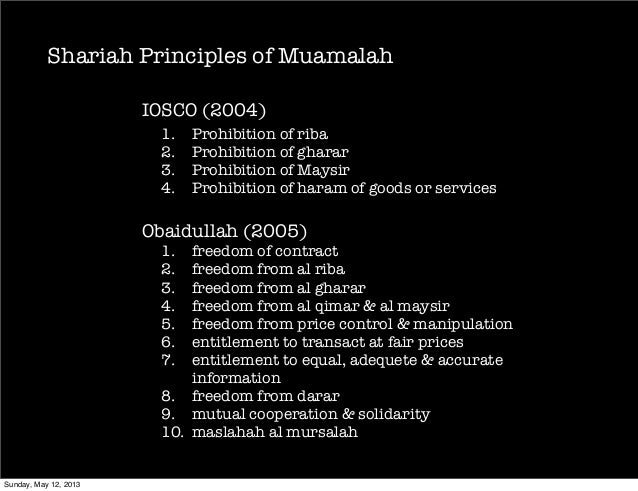

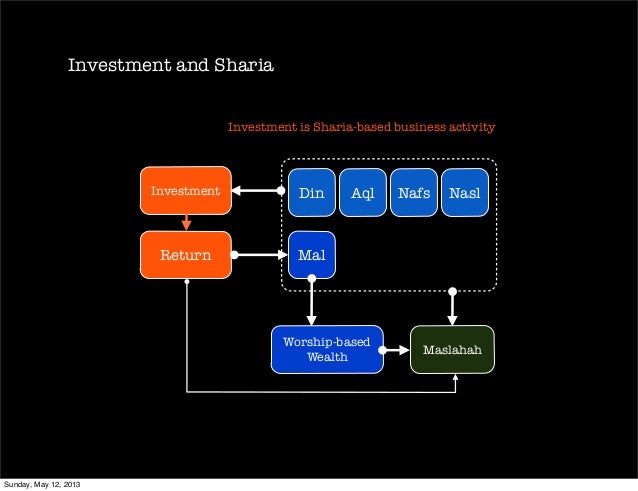

Islamic Capital Market By Irwan Abdalloh

Islamic Capital Market By Irwan Abdalloh

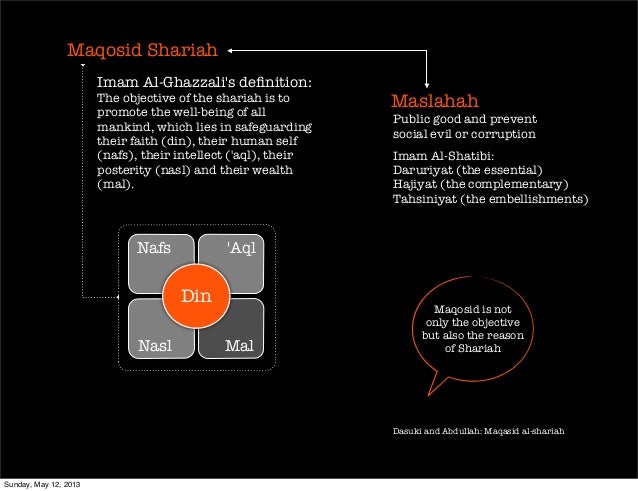

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Islamic Capital Market By Irwan Abdalloh

Islamic Capital Market By Irwan Abdalloh

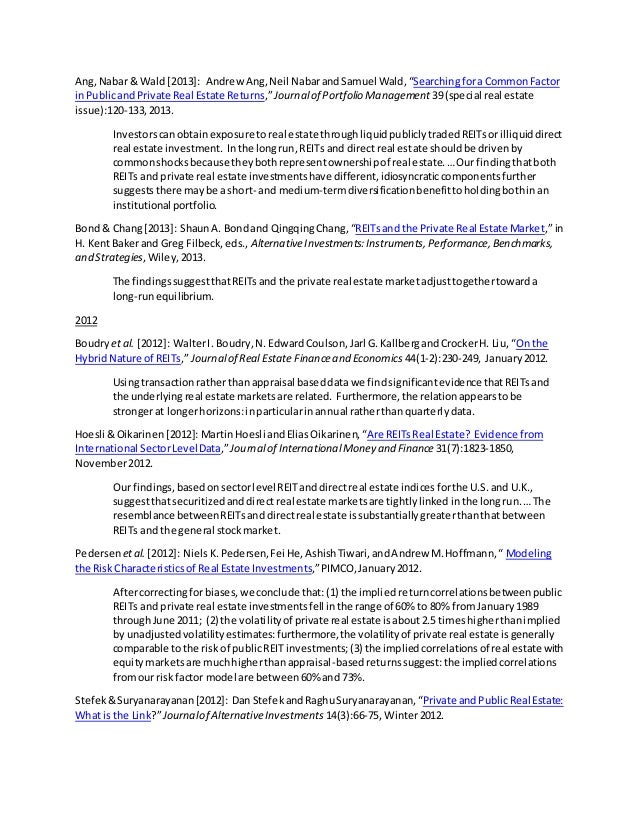

Are Listed Equity Reits The Same As Unlisted Real Estate Bibliography

Are Listed Equity Reits The Same As Unlisted Real Estate Bibliography

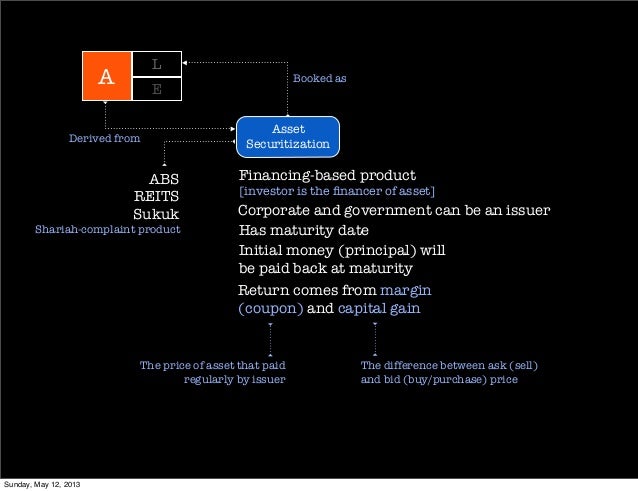

Islamic Capital Market By Irwan Abdalloh

Islamic Capital Market By Irwan Abdalloh

Islamic Capital Market By Irwan Abdalloh

Islamic Capital Market By Irwan Abdalloh

Are Listed Equity Reits The Same As Unlisted Real Estate Bibliography

Are Listed Equity Reits The Same As Unlisted Real Estate Bibliography